DCN 1099 Explainer

English

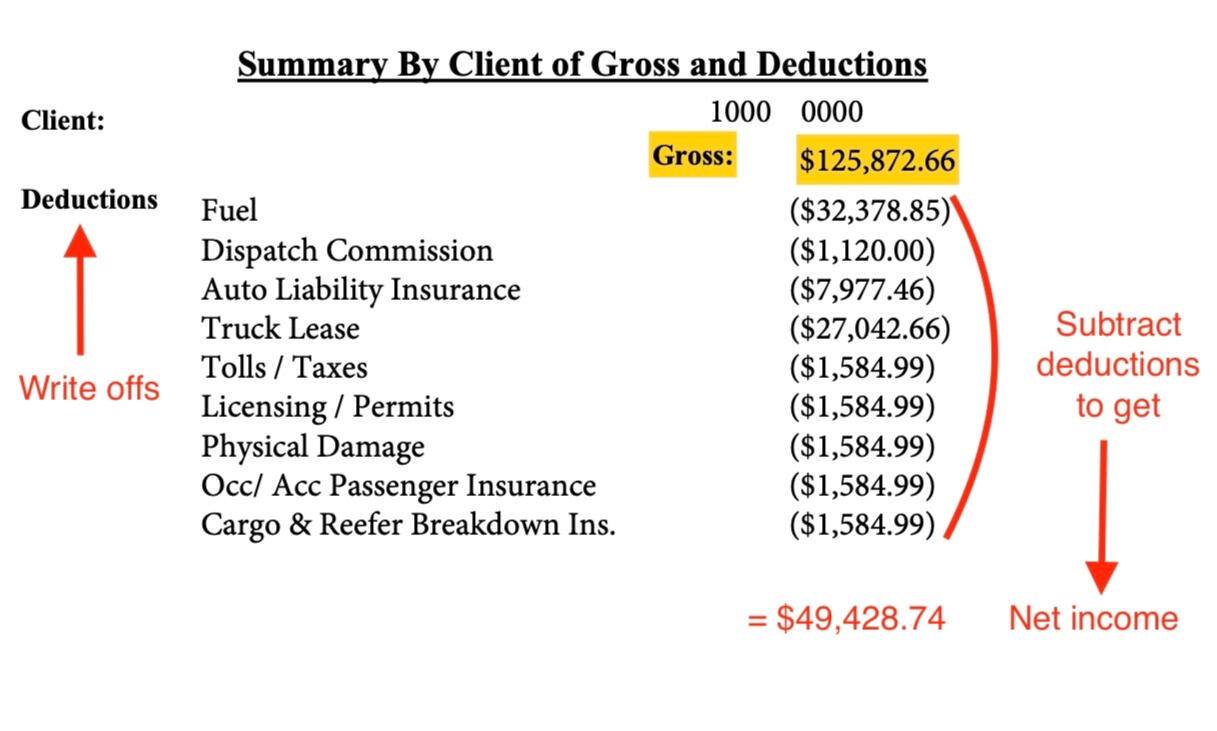

In the top right of the 1099 you will see a section that looks like this.

Gross: The amount earned before any deductions taken out.Deductions: Expenses already taken out, need to be subtracted from gross to get your Net amount.Proof of Deductions: The 1099 and your paystubs are sufficient proof that these amounts were deducted from you gross income to get your net amount.Please make sure your tax professional includes these deductions in your tax return.

Additional Deductions you can take:Per Diem rate for meals: 80% of $69 (01/01/24-09/30/24), $80 (10/01/24-12/31/24) per full day away from your tax home, and $51.75 per partial day. Please consult with your tax professional to ensure you are properly applying these on your taxes.Percentage of your cell phone and phone plan: (the percentage that you use your phone for work)Necessary Personal Expenses: Only qualifies if the expense was neded to complete your job. Please note that plain clothing such as tee-shirts and Jeans do not qualify. Here are a few examples.

(Links are clickable)

Flashlights, Gloves, Tablet, Boots, Cooler, Tools, Safety Clothing, Showers, Bedding

Українська

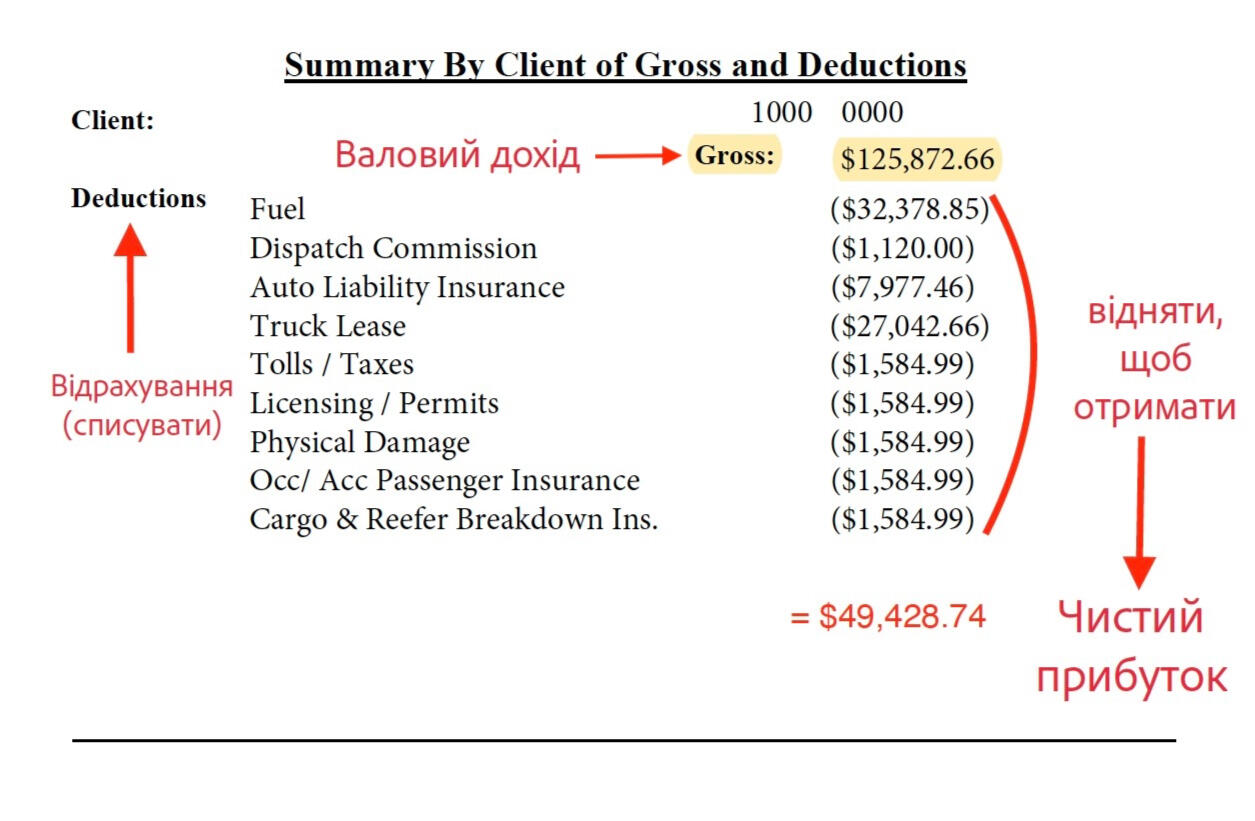

У верхньому правому куті вашого 1099

Gross: (Валовий дохід) Сума, зароблена до вилучення будь-яких відрахувань.Deductions: Відрахування (Списуються) Витрати, які вже вилучено, потрібно відняти від валових, щоб отримати чисту суму.Будь ласка, переконайтеся, що ваш податковий спеціаліст включив ці відрахування у вашу податкову декларацію.

Додаткові відрахування, які ви можете отримати:Per Diem: (Добові) $69 (01/01/24-09/30/24), $80 (10/01/24-12/31/24) за повний поза домом та $51.75 за неповний день. Проконсультуйтеся зі своїм податковим спеціалістом, щоб переконатися, що ви правильно застосовуєте їх до своїх податків.Відсоток вашого мобільного телефону та тарифного плану: (відсоток, який ви використовуєте телефон для роботи)Необхідні витрати: відповідає вимогам, лише якщо витрати були необхідні для виконання вашої роботи. Будь ласка, зверніть увагу, що простий одяг, такий як футболки та джинси, не відповідає критеріям. Ось кілька прикладів.

(Посилання клікабельні)

Фанарик, Рукавички, Планшет, Черевики, Кулер, Інструменти, Захисний одяг, Душ, Постільна білизна

Disclosure

This Influencer Disclosure Policy is valid as of January, 8 2024. This policy covers the below social channels owned and managed by (Towadi) :These channels strive to abide by the FTC Guidelines for online influencers. The owner believes in honesty of relationship, opinion, and identity. Paid content, advertising space or post will be clearly identified as paid or sponsored content in accordance with the FTC Guidelines.

The owner of these social channels are compensated to provide opinion on products, services, websites and various other topics. Even though the owner(s) of these social media channels receive compensation for our posts or advertisements, we always give our honest opinions, findings, beliefs, or experiences on those topics or products. The views and opinions expressed through these channels are purely the bloggers’ own. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer, provider or party in question.Affiliate Disclosure

In compliance with the FTC guidelines, please assume that all links, posts, photos and other material on this website:

Any/all of the links on this website are affiliate links of which Dinas Cookery receives a small commission from sales of certain items, but you will pay the same price.

Towadi is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com, MYHABIT.com, SmallParts.com, or AmazonWireless.com. Pages on this site may include affiliate links to Amazon and its affiliate sites on which the owner of this website will make a referral commission.By clicking on an external link on this website your are doing so at your own risk.